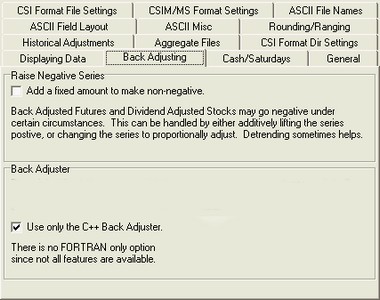

When creating a new portfolio and when editing portfolio settings, UA lets you select your preferences for Back Adjusting continuous futures contracts as shown:

\

\

Raise Negative Series

The upper half of this screen gives the option to, "Add a fixed amount to make non-negative." This refers, of course, to negative values created through the creation of adjusted continuous data files.

Back- and forward-adjusted continuous contracts can regress to negative values into the past. This is one of two options allowing you to avoid negative numbers. The resulting data (including current contract prices) will be adjusted upward by the absolute value of the maximum dip below zero rounded up to the nearest 1,000 points. For example, if a PB series gets down to -69.07, then 6907 is rounded up to 7000. The low price of the modified series is then -69.075 + 70.00 = 0.925 which would display as .92.

In a commodity such as crude oil, which produces negative back-adjusted prices into the past, this option will force recent prices to appear as much as double the current price.

Consider using a Ratio/Proportional Adjusted Contract, or use the detrend option as alternative methods to keep your backadjusted series from going negative.

Back Adjuster

The lower half of the Back Adjusting screen (in Portfolio or Non-Portfolio Chart Settings) gives the option of using the C++ Back Adjuster and gives a brief explanation. Here is more background on the two choices:

The "back adjuster" refers to the algorithm used to select contracts in back-adjusted continuous files when rolling on volume and/or open interest is selected. UA offers two methods for back-adjusting data. The original (standard) method is written in FORTRAN and the newer (alternate) method is written in C++.

Both back adjusters adopt the rule that no regression will take place. In other words when the market is viewed backwards in time as with the standard back adjuster, successive delivery months will have to be earlier in date; if the market is viewed forward in time, as with the alternate back adjuster, successive delivery months will have to be later in date.

The cotton market provides a good example of how the standard back adjuster compiles its historical series by viewing the data backward in time and the alternate back adjuster views the markets forward in time. In the cotton market, after traders are finished with the May contract, there is a tendency to take a position in the December cotton contract because volume and open interest for the December contract often exceed the volume and open interest of the intervening July and October contracts. Open interest and volume tell us that December is favored over the October and July contracts which lie between May and December. The July and October contracts do not capture the interest of most traders until a couple of months from their respective expiration dates.

Because the alternate back adjuster does not regress to an earlier delivery month, the December delivery month remains in force, even though traders may favor the July or October deliveries when those intermediate contracts get closer to expiration. What this means to the alternate (C++) back adjuster is that once the May contract approaches its final delivery day, the open interest and volume are likely to favor the December contract. This occurs as early as April or May of the same year. Hence rolling takes place from May to December, leaving out the effects of both July and October, contrary to the trading preferences of the average cotton trader.

In the case of the standard (Fortran) back adjuster, which views the market from the most recent information backward in time, the December cotton contract is introduced first. From there, a backward rolling will sometimes favor the October contract, but will usually roll backward to the July contract because the May contract may have already expired. Because of this, the standard back adjuster will step from contract to contract backward in time, picking up the new contract which is dictated by maximum open interest or volume or both.

Another minor difference between the standard and alternate C++ back adjusters is that the alternate version requires two or more days of confirmation on volume and open interest before invoking any action to roll forward. Because the user has the option to roll when both volume and open interest effects are confirmed, the standard back adjuster requires only one day of confirmation.

A summary of differences between the standard and alternate back adjuster is included in Bob Pelletier's essay, "Computed Contracts: Their Meaning, Purpose and Application" (see Back-and Forward-Adjusted Contracts) in this manual.

Check this box (click it) to use only the alternate C++ adjuster. There are some instances when, due to new program features, the C++ (alternate) back adjuster will be used, even if this box is unchecked.

\

\

\

\